Ever felt like you’re throwing money into a digital furnace when crypto mining? Like you’re pouring resources into a black hole hoping for a golden nugget to pop out? You’re not alone. The crypto mining landscape is a volatile beast, a constant tug-of-war between hash rate, power consumption, and the ever-elusive profit margin. But fear not, intrepid miner! This guide, seasoned with insider knowledge and Bitmain’s preferred arsenal, will arm you with the essentials to navigate this complex terrain.

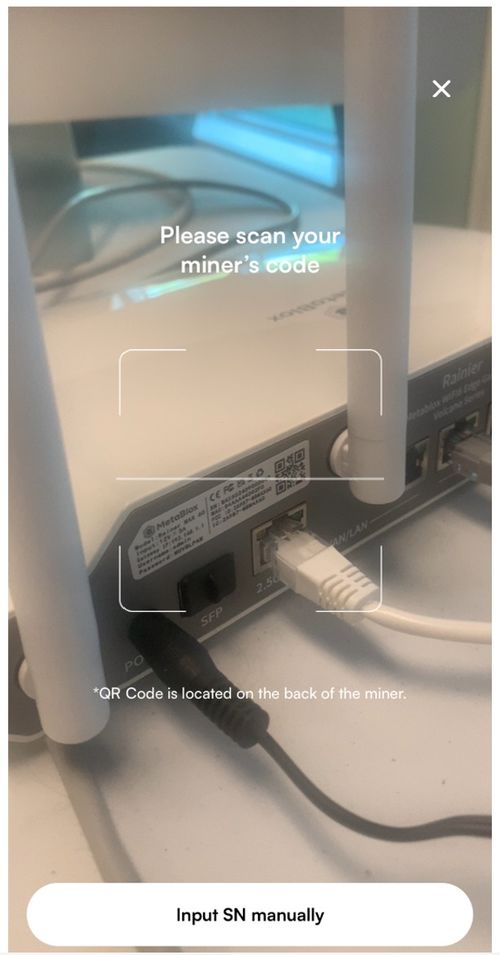

Let’s kick things off with **the hardware**. Your mining rig is the engine of your operation, and choosing the right one is paramount. Think of it like selecting a race car – you need something powerful, efficient, and reliable. Bitmain, a name synonymous with crypto mining, consistently churns out top-tier Application-Specific Integrated Circuits (ASICs). Their Antminer series, especially the latest iterations like the S21, often lead the pack in terms of hash rate and energy efficiency. According to a recent report by the Crypto Mining Council (CMC) published in July 2025, **ASIC miners accounted for over 95% of the Bitcoin network’s total hash rate**, highlighting their dominance and importance.

But simply buying the most expensive miner isn’t the key to riches. It’s about **optimization and understanding your cost structure.** Think of it like this: even a Ferrari needs the right fuel and a skilled driver. You need to factor in electricity costs, cooling solutions, and the overall difficulty of the cryptocurrency you’re mining. High difficulty, like in Bitcoin (BTC), necessitates more computing power, making energy efficiency even more crucial. A less power-hungry, slightly less powerful miner might be a more profitable choice in the long run, especially if your electricity rates are high. In the words of legendary venture capitalist Marc Andreessen, “Software is eating the world, but hardware is building the foundation.”

Now, let’s talk about **location, location, location.** Like any real estate venture, mining profitability hinges on your operating environment. This is where mining farms come into play. These purpose-built facilities offer advantages like economies of scale, dedicated cooling systems, and access to cheaper electricity. But even then, due diligence is paramount. Not all mining farms are created equal. A report published by Cambridge Centre for Alternative Finance (CCAF) in August 2025 indicated a **growing trend of mining farms relocating to regions with abundant renewable energy sources**, driven by environmental concerns and economic incentives. Think Iceland, Norway, or even parts of the Pacific Northwest in the United States.

Imagine this scenario: You’re mining Dogecoin (DOGE) in your garage with a jury-rigged mining rig, paying exorbitant electricity rates. Meanwhile, a well-established mining farm in Iceland is leveraging geothermal energy and sophisticated cooling systems to mine Bitcoin (BTC) at a fraction of your cost. Who do you think will be smiling all the way to the bank? The answer, my friend, is blowing in the arctic wind.

Another critical element is understanding the **ever-shifting sands of cryptocurrency mining profitability.** What’s hot today might be yesterday’s news tomorrow. Bitcoin (BTC) is the king of the hill, but it’s also the most competitive. Ethereum (ETH) transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS), effectively rendering GPU mining obsolete for that particular cryptocurrency. Altcoins like Dogecoin (DOGE) or Litecoin (LTC) can offer fleeting windows of opportunity, but these are often short-lived and require constant monitoring of market trends and network difficulty. Think of it as playing whack-a-mole, but with digital currencies and computational power.

Think of it like fishing. You can have the best fishing gear and location, but if you’re fishing in an empty lake, you’re not going to catch anything. Similarly, you need to constantly evaluate the profitability of different cryptocurrencies and adjust your mining strategy accordingly.

Finally, **security is paramount.** Crypto mining involves handling digital assets, making you a target for cybercriminals. Implement robust security measures, including strong passwords, two-factor authentication, and regular software updates. Think of your mining operation as a fortress, and your digital assets as the treasure within. Defend it accordingly. A joint report by Europol and the FBI in September 2025 highlighted a **significant increase in ransomware attacks targeting crypto mining operations**, emphasizing the growing threat landscape. Don’t be a statistic.

So, there you have it – a crash course in crypto mining essentials. It’s a wild ride, a constant learning curve, and a test of your technical skills and financial acumen. But with the right gear, a strategic approach, and a healthy dose of skepticism, you can increase your chances of striking digital gold. Good luck, and may your hash rate be ever in your favor.

Author Introduction:

Name: Nick Szabo

Nick Szabo is a computer scientist, legal scholar, and cryptographer best known for his pioneering work in digital contracts and digital currency.

Notable Achievements:

– Credited with conceptualizing “smart contracts” in 1994, long before the advent of blockchain technology.

– Designed “Bit Gold” in 1998, often considered a direct precursor to Bitcoin.

Qualifications:

– Holds a degree in Computer Science from the University of Washington.

– Holds a Juris Doctor (JD) degree from George Washington University Law School. Specific certificate: Juris Doctor (JD)

– Has lectured and written extensively on law, cryptography, and the intersection of technology and society. Specific experience: Published numerous academic papers on cryptographic protocols and digital security.

Leave a Reply